TCFD Support

The Taskforce on Climate-related Financial Disclosure (TCFD) is a framework launched by the Financial Stability Board (FSB) in 2015. The recommendations of the TCFD provide guidance to organizations on disclosing the financial impact of climate-related risks and opportunities. The recommendations consider 4 core disclosure elements:

Governance over climate related risks and opportunities.

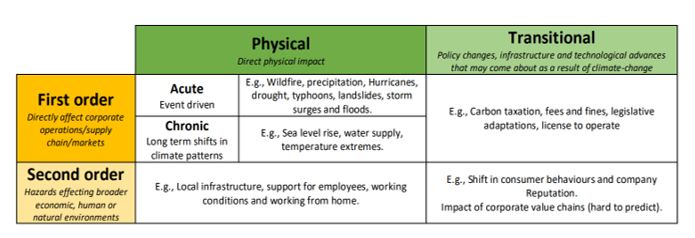

Strategy – how climate change has the potential to impact business strategy and financial planning. Scenario analysis is recommended as a tool under this element.

Risk Management – process for identification, management, and integration of potential climate-related risks.

Metrics and Targets associated with climate-related risks and opportunities, including disclosure of Scope 1, 2 and relevant Scope 3 greenhouse emissions, and progress to targets.

Image Source: TCFD 2017

Since 6 April 2022 this is a mandatory reporting framework in the UK for:

- Organisations currently required to produce an annual non-financial statement (e.g. traded companies, banks and insurers with over 500 employees)

- UK-based AIM companies with 500 or more employees

- LLPs and non-listed companies with 500 or more employees and a turnover of more than £500M

Carbon Footprint provides cost effective support to clients with the environmental aspects of TCFD disclosure, including:

- Carbon Footprint Assessment or Carbon Footprint Verification, assessing or verifying of your organisation’s Carbon Footprint .

- Developing and monitoring progress to Targets for reducing emissions.

- Climate-related Scenario Analysis workshops and a report on the outcomes, including the key risks and opportunities identified for your business (Strategy).

We can also provide guidance on how to integrate these elements into your wider, TCFD-aligned risk management processes or annual financial reporting.

Contact Us - For Support with TCFD